INTRADAY CONTRACTS SURPASS 64% AMID GROWING REGIONAL TENSION AND EXPIRED ULTIMATUM TO MADURO

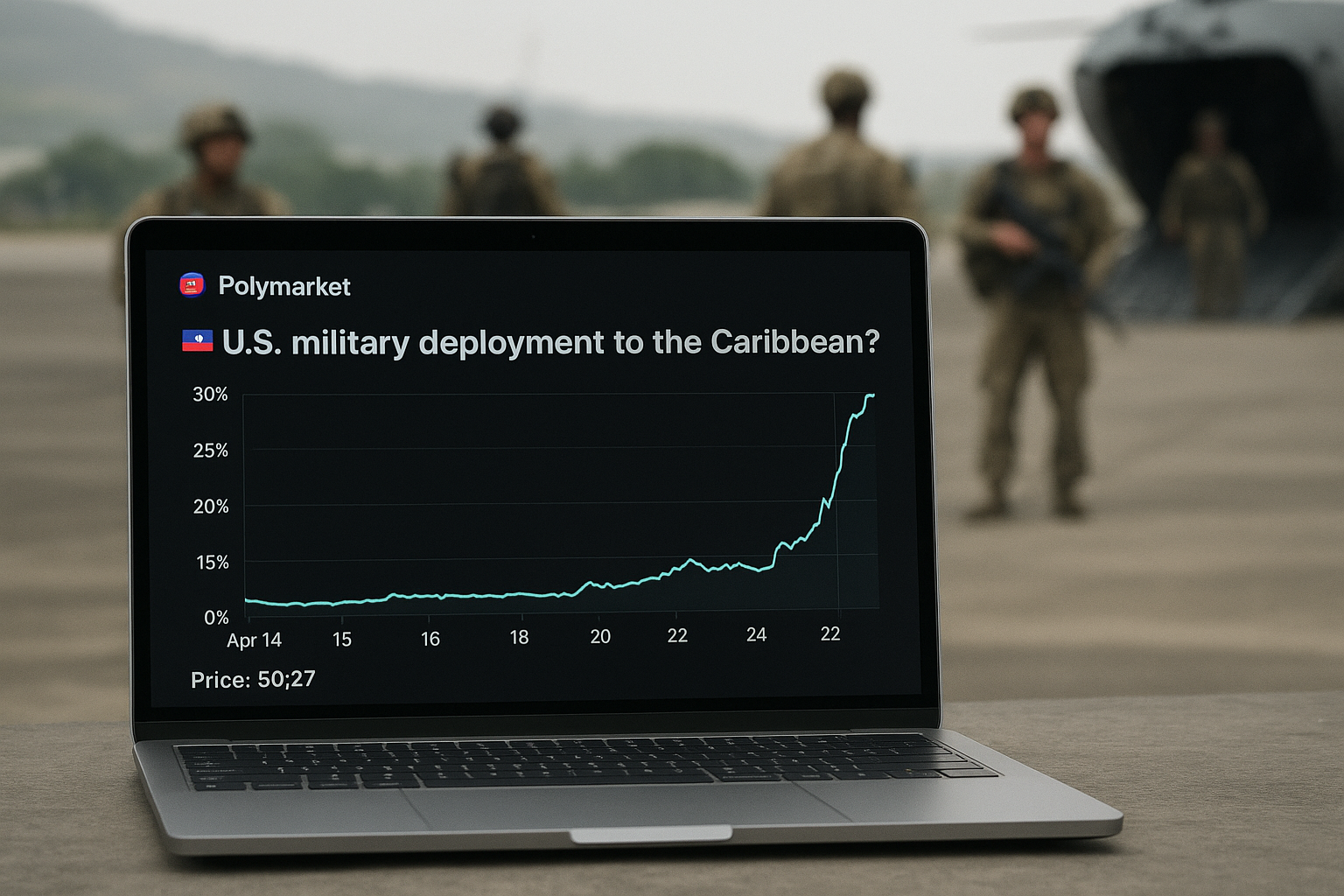

Forecasting platform Polymarket shows rising probabilities of a potential U.S.–Venezuela military confrontation as tensions escalate following Washington’s ultimatum to Maduro and increased U.S. deployments in the Caribbean.

FULL ARTICLE

Prediction market Polymarket is showing a significant increase in the implied probability of a potential military confrontation between the United States and Venezuela. According to live trading data, several contracts are nearing — and in some cases surpassing — the thresholds that would trigger an affirmative resolution before Friday, reflecting rapidly intensifying geopolitical pressure.

Intraday indicators have climbed above 64%, signaling traders’ expectations of escalating tension following the expiration of Washington’s recent ultimatum to Nicolás Maduro. The ultimatum, which demanded specific commitments from Caracas, passed without compliance, prompting speculation about potential U.S. actions.

Analysts caution that prediction markets are not evidence of government intent but rather reflect trader sentiment shaped by public information, media coverage, and perceived geopolitical risk. Still, the sharp movement in Polymarket odds aligns with signs of increased U.S. activity in the Caribbean, including strategic deployments and heightened military readiness.

Experts note that both nations remain publicly noncommittal about direct conflict. The White House has avoided explicit statements, and Venezuela has issued broad accusations of foreign interference. Nevertheless, the market reaction demonstrates heightened global uncertainty.

Regional organizations are urging diplomatic channels to remain open to avoid escalation, especially given Venezuela’s internal instability and ongoing humanitarian crisis. Economists warn that any confrontation would carry significant economic and energy repercussions across the hemisphere.

Polymarket’s rising odds underscore the volatility of the current moment — but analysts stress that markets often overreact during periods of intense speculation. More clarity may emerge in the coming days as Washington weighs its next steps.